Don’t Make These Mistakes When Selling Your House

Don’t Make These Mistakes When Selling Your House

Are you thinking about selling your house? Some common mistakes today can make the process more stressful or even cost you money.

Fortunately, they’re easy to avoid, as long as you know what to watch for. Let’s break down the biggest seller slip-ups, and how an agent helps you steer clear of them.

1. Overpricing Your House

It’s completely natural to want top dollar for your house, especially if you’ve put a lot of work into it. But in today’s shifting market, pricing it too high can backfire. Investopedia explains:

“Setting a list price too high could mean your home struggles to attract buyers and stays on the market for longer.”

And your house sitting on the market for a long time could lead to price cuts that raise red flags. That’s why pricing your house right from the start matters.

A BHG Service First Realtor will look at what other homes nearby have sold for, the condition of your house, and what’s happening in your market right now. That helps them find a price that’s more likely to bring in buyers, and maybe even more than one offer.

2. Spending Money on the Wrong Upgrades

The housing market has nearly a half million more sellers than buyers according to Redfin. That means you have more competition as a seller and may have to do a bit more to get your house ready to sell. But not all projects are going to be worth it. If you spend money on the wrong projects, it could really cut into your profit.

A BHG Service First Realtor knows what buyers in your area are really looking for, and they can help you figure out which projects are worth it, and which ones to skip. Even better, they’ll know how to highlight any upgrades you make in your listing, so your house stands out online and gets more attention.

3. Refusing To Negotiate

Now that inventory is starting to grow a bit, it’s important to stay flexible. Buyers have more options – and with it comes more negotiating power. U.S. News explains:

“If you’ve received an offer for your house that isn’t quite what you’d hoped it would be, expect to negotiate . . . make sure the buyer also feels like he or she benefits . . . consider offering to cover some of the buyer’s closing costs or agree to a credit for a minor repair the inspector found.”

That’s where your agent comes in. They’ll help you understand what buyers are asking for, what’s normal in today’s market, and how to find a win-win solution. Sometimes making a small compromise can keep the deal moving and help you move on to your next chapter faster.

4. Skipping Research When Hiring an Agent

All of these mistakes are avoidable with the help of a skilled agent. So, you want to be sure you’re working with the right partner. Still, according to the National Association of Realtors (NAR), 81% of sellers pick the first agent they talk to.

Many homeowners may skip basic steps like reading reviews, checking sales history, and interviewing a few agents. But that’s a mistake. You want someone you know you can rely on – someone with a good track record. A BHG Service First Realtor can help you price your house right, market it well, and sell it quickly (and maybe for more money).

Bottom Line

Selling a house doesn’t have to be stressful, especially if you have an experienced agent by your side. Let’s connect so you have an expert to help you avoid these common mistakes and make the most of your sale.

What’s one thing you’d want expert advice on before putting your house on the market?

The Rooms That Matter Most When You Sell

The Rooms That Matter Most When You Sell

Now that buyers have more options for their move, you need to be a bit more intentional about making sure your house looks its best when you sell. And proper staging can be a great way to do just that.

What Is Home Staging?

It’s not about making your house look super trendy or like it belongs in a magazine. It’s about helping it feel welcoming and move-in ready, so it’s easy for buyers to picture themselves living there.

It’s important to understand there’s a range when it comes to staging. It can include everything from simple tweaks to more extensive setups, depending on your needs and budget. But a little bit of time, effort, and money invested in this process can really make a difference when you sell – especially in today’s market.

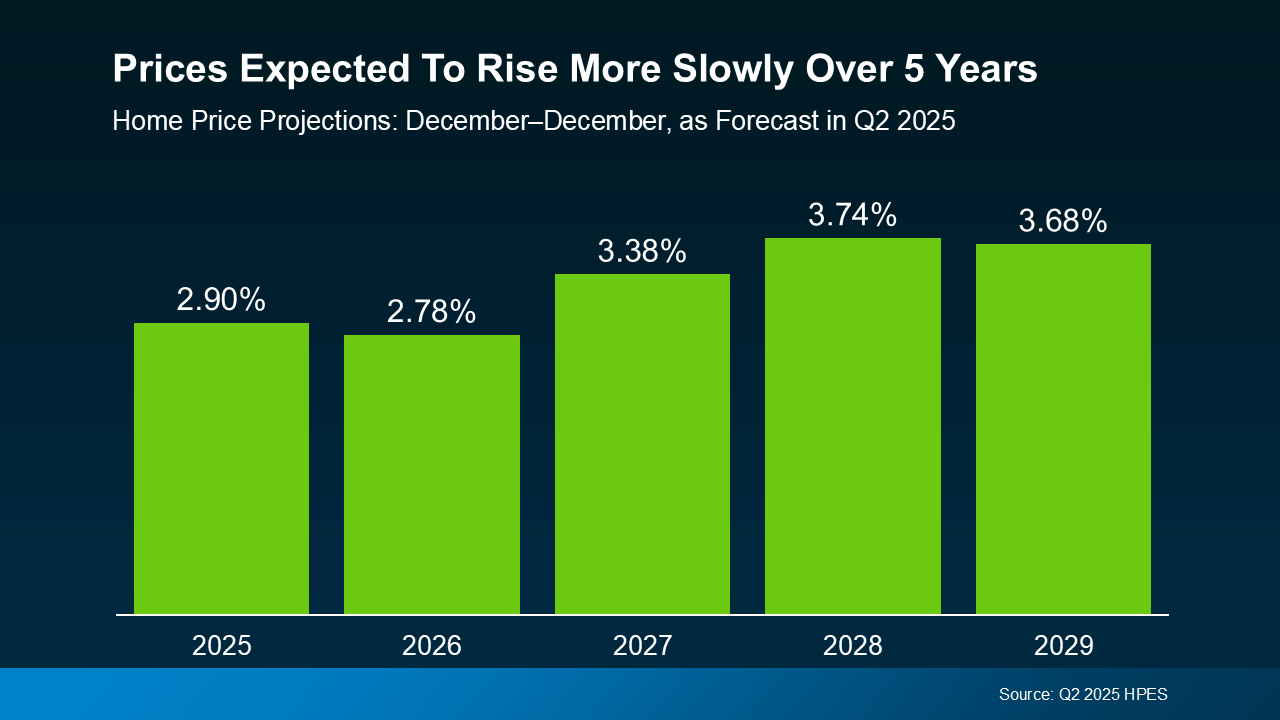

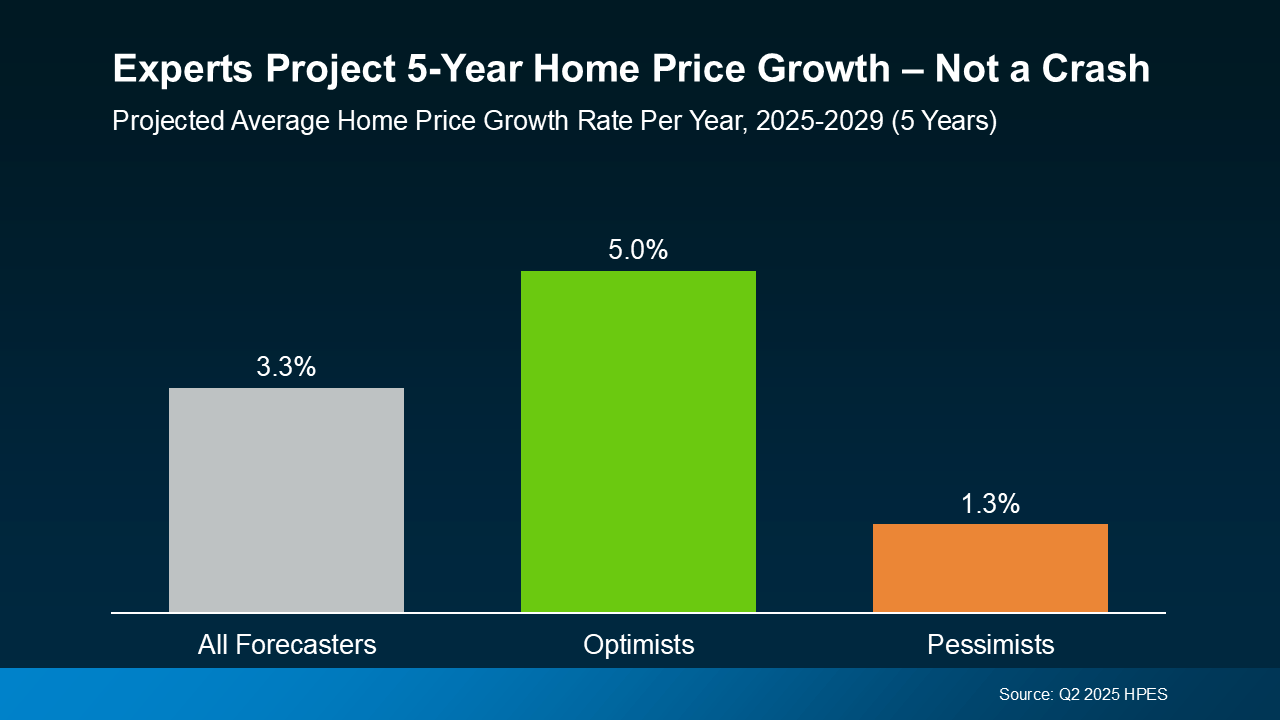

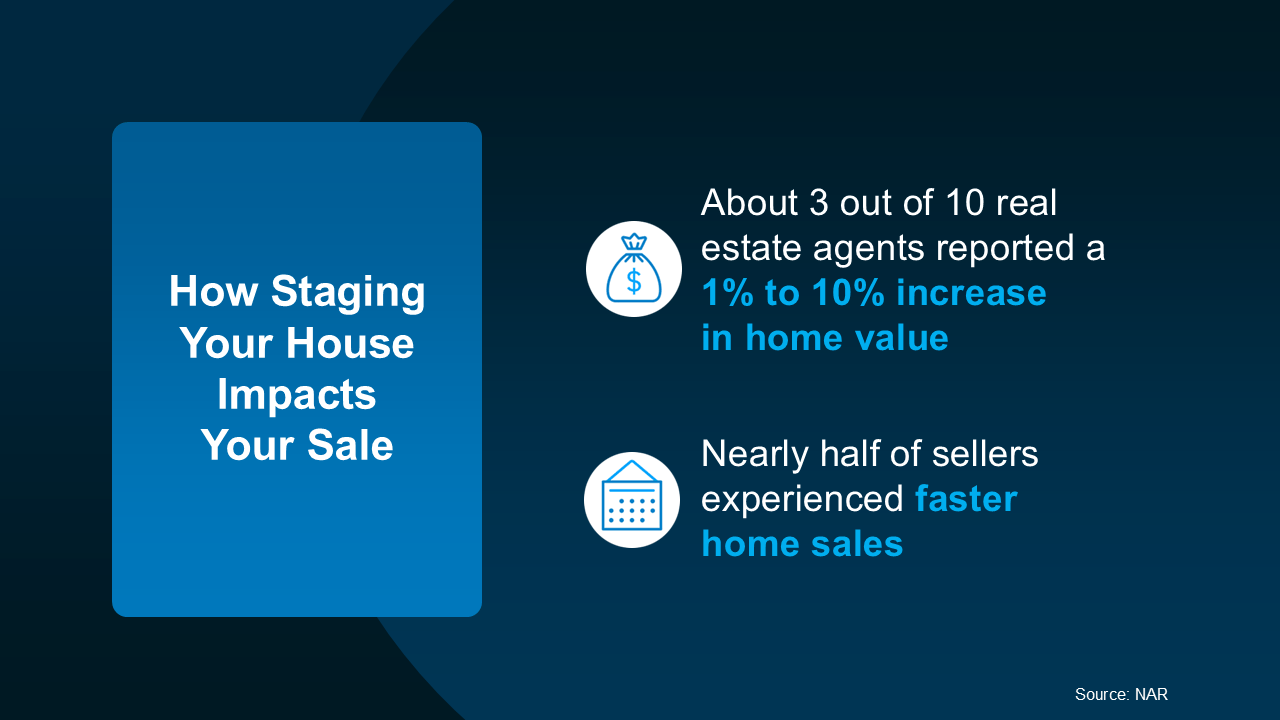

A study from the National Association of Realtors (NAR) shows staged homes sell faster and for more money than homes that aren’t staged at all (see below):

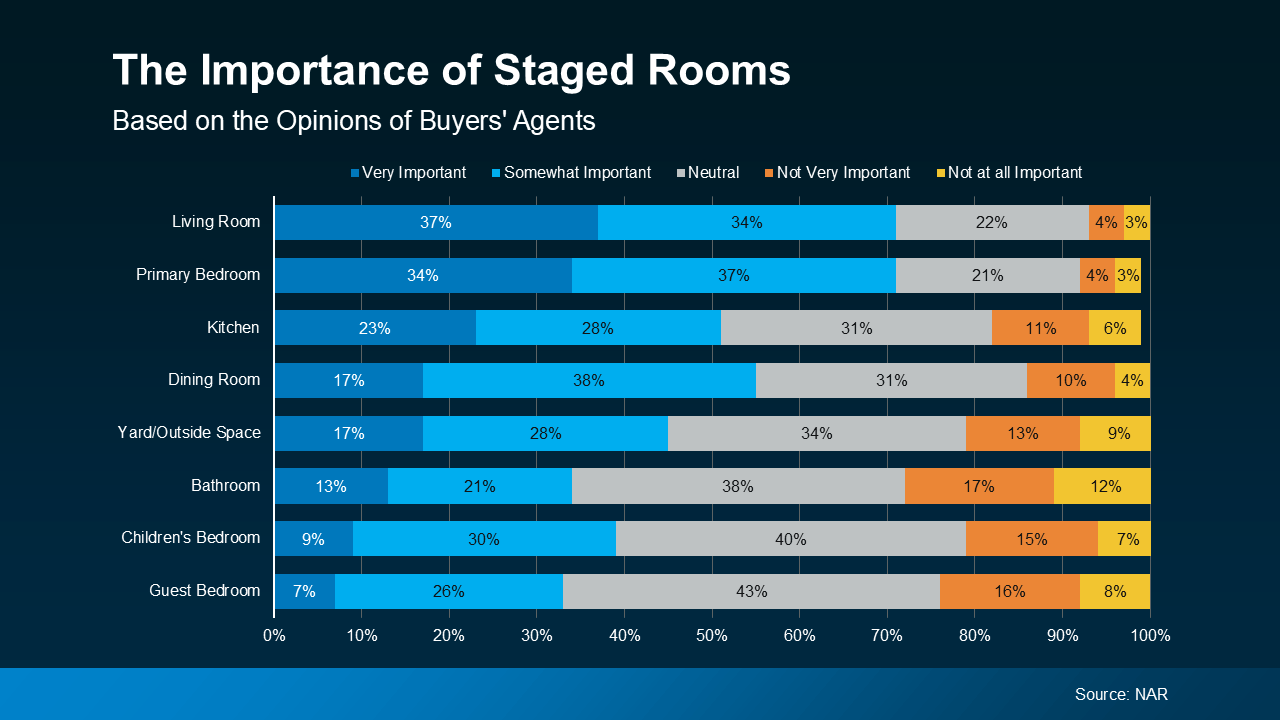

Which Rooms Matter Most?

The best part is, odds are you don’t have to stage your whole house to make an impact. According to NAR, here’s where buyers’ agents say staging can make the biggest difference (see graph below):

As you can see, agents who talk to buyers regularly agree, the most important spaces to stage are the rooms where buyers will spend the most time, like the living room, primary bedroom, and kitchen.

As you can see, agents who talk to buyers regularly agree, the most important spaces to stage are the rooms where buyers will spend the most time, like the living room, primary bedroom, and kitchen.

While this can give you a good general idea of what may be worth it and what’s probably not, it can’t match a local agent’s expertise.

How an Agent Helps You Decide What You Need To Do

Agents are experts on what buyers are looking for where you live, because they hear that feedback all the time in showings, home tours, walkthroughs, and from other agents. And they’ll use those insights to give their opinion on your specific house and what areas may need a little bit of staging help, like if you need to:

- Declutter and depersonalize by removing photos and personal items

- Arrange your furniture to improve the room’s flow and make it feel bigger

- Add plants, move art, or re-arrange other accessories

A lot of buyers can use the agent’s know-how as the only staging advice they need. But, if your home needs more of a transformation, or it’s empty and could benefit from rented furniture, a great agent will be able to determine if bringing in a professional stager might be a good idea, too. Just know that level of help comes with a higher price tag. NAR reports:

“The median dollar value spent when using a staging service was $1,500, compared to $500 when the sellers’ agent personally staged the home.”

A local agent will help you weigh the costs and benefits based on your budget, your timeline, and the overall condition of your house. They’ll also consider how quickly similar homes are selling nearby and what buyers are expecting at your price point.

Bottom Line

Staging doesn’t have to be over-the-top or expensive. It just needs to help buyers feel at home. And a great agent will help you figure out the level of staging that makes the most sense for your goals.

Which room in your house do you think would make the biggest impression on a buyer?

Your BHG agent can walk through your home with you and discuss what will make your house stand out!

Don’t have a BHG agent yet? Connect with one today by going to: https://bhgservicefirst.com/directory

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

Last year, 70% of buyers abandoned their home search – and maybe you were one of them. It makes sense. Inventory was low, prices were high, and mortgage rates were up and down like a rollercoaster. All of that made it really hard to find a home you loved – and could afford.

But guess what? The market is shifting.

So, if you paused your moving plans in 2024, it might be time to hit play again. Here’s why.

More Inventory Opens Up More Options

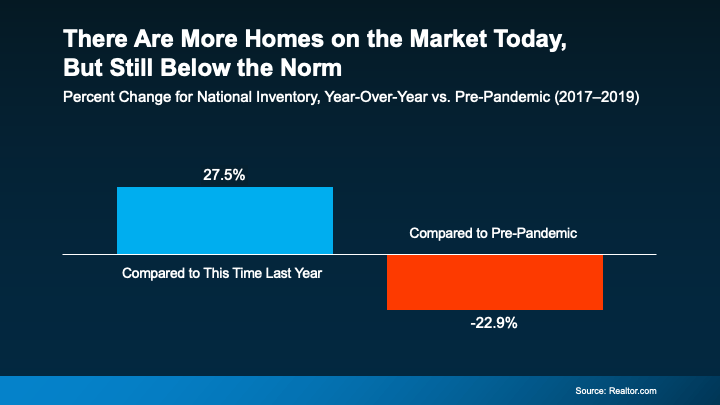

Even if you could make the numbers work, the lack of available homes in recent years probably made it hard to come by something that fit your needs. But inventory is starting to rise. In Macon County, inventory in the first two months of 2025 was up 4.7% over the first two months of 2024.

According to Realtor.com, inventory has jumped 27.5% since this time last year (see graph below):

So, if you were reluctant to list your house because you weren’t sure where you’d go if it sold, you have more choices than you did a year ago. That’s a big win.

Homes Are Staying on the Market Longer, Too

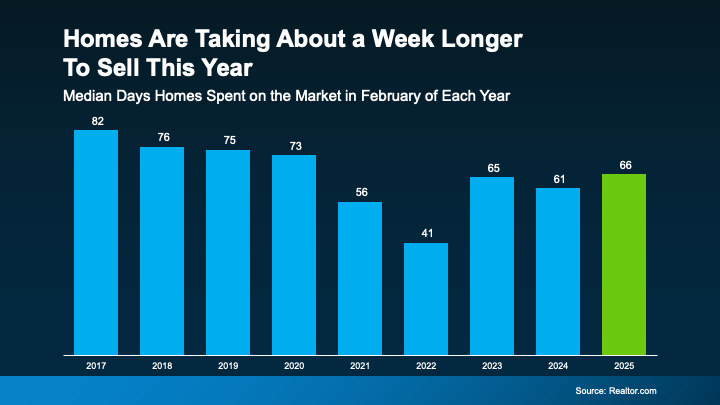

When the supply of homes for sale is low, they’re snatched up quickly because there just aren’t enough of them to go around. And a few years ago, that meant your house could sell overnight. While that’s not always a bad thing, if you’re planning a move and also need to find your next home, a slower pace isn’t the end of the world. In fact, it’s welcome relief.

Now that inventory has grown, homes are staying on the market longer, meaning you don’t have to feel as rushed in the process (see graph below):

The latest data shows the typical time homes spent on the market went up by about 8% this year – that’s higher than we’ve seen since 2020, but still a faster pace than before the market ramped up. And it’s about a week longer than last year. Talk about a sweet spot for movers. It may seem like just a few days, but it gives you more flexibility and time to be thoughtful about your decisions. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, notes:

“There are more homes for sale than in the last few years, which means the market pace is a bit more manageable–with longer days on market–and many sellers are more flexible . . . Though buyers face still-high housing costs, they may find a bit more give in the market, which could give them more time to make a decision, even in the busy spring and summer months.”

And if you’re thinking – but wait – doesn’t that mean it will be harder to sell my house? Don’t worry. With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling, especially as more buyers step back into the game this season.

Bottom Line

With growing inventory, sellers who want to upgrade, downsize, or relocate have more choices. Plus, with less pressure to rush into an offer, it could be a great time to revisit your home search if you’ve put it on hold.

With more homes on the market and more time to make decisions, what else do you need to see in order to kickstart your home search again? Let’s talk about what’s happening in our local market right now. Reach out to a BHG Service First agent today!

Welcome, Heather Saffer!

Please join us in welcoming Heather Saffer to the BHG Servie First Team!

Heather started her real estate career in 2014 and is returning now after a few years of pursuing other ventures. Specializing as a buyer’s agent in rural markets, she’s a country girl and native of the area. She is looking forward to unlocking doors that lead to your dreams.

You can call or text Heather at 217-330-4714 or visit her website at: https://heathersaffer.sites.bhgrealestate.com/

Worried About Mortgage Rates? Control the Controllables

Chances are you’re hearing a lot about mortgage rates right now. You may even see some headlines talking about last week’s Federal Reserve (the Fed) meeting and what it means for rates. But the Fed doesn’t determine mortgage rates, even if the headlines make it sound like they do.

The truth is, mortgage rates are impacted by a lot of factors: geo-political uncertainty, inflation and the economy, and more. And trying to pin down when all those factors will line up enough for rates to come down is tricky.

That’s why it’s generally not worth it to try to time the market. There’s too much at play that you can’t control. The best thing you can do is control the controllables.

And when it comes to rates, here’s what you can influence to make your moving plans a reality.

Your Credit Score

Credit scores can play a big role in your mortgage rate. As an article from CNET explains:

“You can’t control the economic factors influencing interest rates. But you can get the best rate for your situation, and improving your credit score is the right place to start. Lenders look at your credit score to decide whether to approve you for a loan and at what interest rate. A higher credit score can help you secure a lower interest rate, maybe even better than the average.”

That’s why it’s even more important to maintain a good credit score right now. With rates where they are, you want to do what you can to get the best rate possible. If you want to focus on improving your score, your trusted loan officer can give you expert advice to help.

Your Loan Type

There are many types of loans, each offering different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose.”

Work with your BHG real estate professional and local, professional lender to make sure you find out what’s available for your situation and which types of loans you may qualify for.

Your Loan Term

Another factor to consider is the term of your loan. Just like with loan types, you have options. Freddie Mac says:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Depending on your situation, the length of your loan can also change your mortgage rate.

Bottom Line

Remember, you can’t control what happens in the broader economy. But you can control the controllables.

Work with a trusted lender to go over the things you can do that’ll make a difference. By being strategic with these factors, you may be able to combat today’s higher rates and lock in the lowest one you can.

What To Know About Credit Scores Before Buying a Home

What To Know About Credit Scores Before Buying a Home

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains:

“A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So, when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible.”

That means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 770. But that doesn’t mean your credit score has to be perfect. The same article from US Bank explains:

“Your credit score (commonly called a FICO Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.”

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on:

- Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly.

- Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible.

- Credit Applications: If you’re looking to buy something, don’t apply for additional credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score.

Bottom Line

Finding ways to make your credit score better could help you get a lower mortgage rate. If you want to learn more, talk to your trusted Better Homes & Gardens Realtor today!

360-Degree View of the Future Home of Ellsworth Dansby Jr. Magnet School – The Latest Addition to Decatur Public Schools!

If you haven’t been over by Oak Grove Park, you may want to go take a look at the progress of the future home of Ellsworth Dansby Jr. Magnet School – the latest addition to Decatur Public Schools.

Background

On Tuesday, September 26, 2023, the DPS Board of Education approved naming the new building Ellsworth Dansby Jr. Magnet School.

Mr. Ellsworth Dansby Junior was a native of Decatur, born on October 5, 1914. He was a graduate of Decatur High School and one of the first black men to graduate from Millikin University. But what Mr. Dansby is most known for is his military service — he was the second black man to be sworn into the Army Air Force, the first enlisted man in the group to receive the rank of master sergeant during World War II, and a member of the first black aviation unit, the 99th Pursuit Squadron of the Army Air Corps, which later became known as the Tuskegee Airmen.

Also, Mr. Dansby was always fascinated with flying. He and his friends built model airplanes. And, at the age of 12, Mr. Dansby flew an airplane alone at a farm airstrip near Dalton City, taking off and landing safely.

Mr. Dansby began applying to the Air Force shortly after his graduation from high school. He joined the Army Air Force just as the 99th Squadron was activated at Chanute Field in Rantoul and sent to Tuskegee, Alabama. That’s where Mr. Dansby became the first African-American master sergeant and one of the “Tuskegee Airmen,” the nation’s first black military fighter pilots.

Finally, you can find out more about this project and the history behind the man by CLICKING HERE.

Housing in the Area

This Decatur Public School will be near the Home Park area – a great place to live in Decatur, Illinois! You can see the park in this video here: https://www.youtube.com/watch?v=2LxVl4qIdYs

You can find a great home in the Decatur Public School District by connecting with one of our agents.

Take a look at this aerial 360-degree view of the construction site!

Two Brands Under One Roof!

No, Tim did not sell the company. No, Tim did not leave the company. What Tim DID do, is brand and franchise the residential side of the business as Better Homes & Gardens Real Estate Service First! The commercial real estate side of the business will remain under Vieweg Real Estate. So now you will find TWO brands under one roof. The same people you know. The same people you trust. The same address: 601 E. William St. in Decatur, Illinois.

When you list with Better Homes & Gardens for your residential real estate needs, and Vieweg Real Estate for your commercial real estate needs, you can rest assured that you are in the best of hands. We are still #WorkingHardSoYouDontHaveTo, but with our new partnership with Better Homes & Gardens, you will have Better tools. Better service. You can #ExpectBetter. We want to be your #RealtorForLife and go #BeyondTheHome. Our goal is to serve you from our first meeting, to the closing table, and beyond.

If you are looking to buy or sell residential or commercial real estate, you can do both by calling our office at 217-450-8500.

Here’s to a bright and beautiful new year! Here’s a message from Tim Vieweg

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link